Your retirement-plan benefits are very likely a significant portion of your net worth. And because of special tax considerations, they could make an excellent choice for funding a charitable gift.

Retirement-plan benefits include assets held in individual retirement accounts (IRAs), 401(k) plans, profit-sharing plans, Keogh plans, and 403(b) plans.

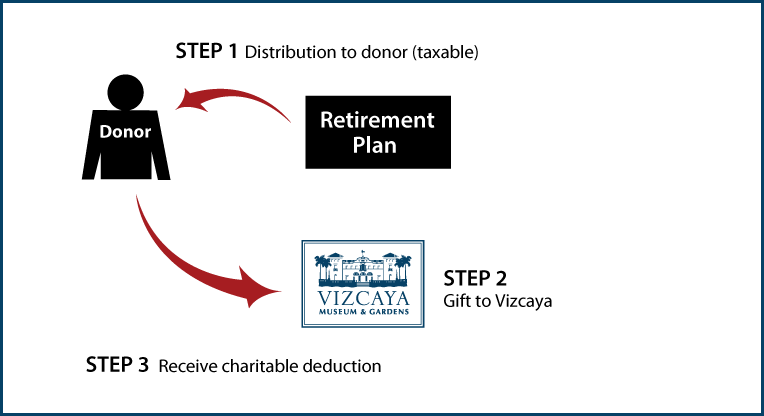

Lifetime Gifts  Click to See Diagram |

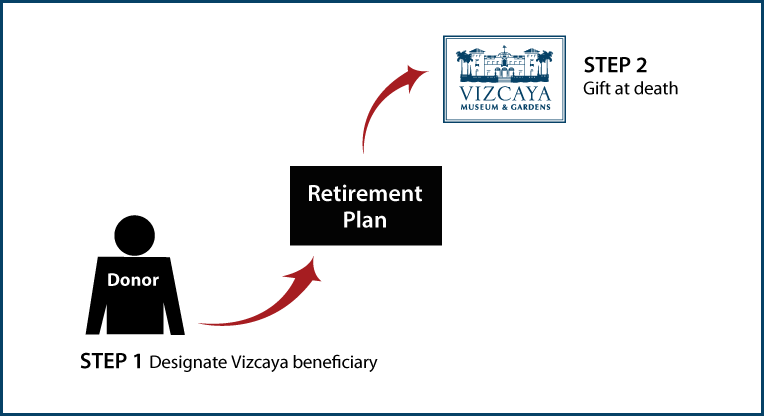

Estate Gifts  Click to See Diagram |

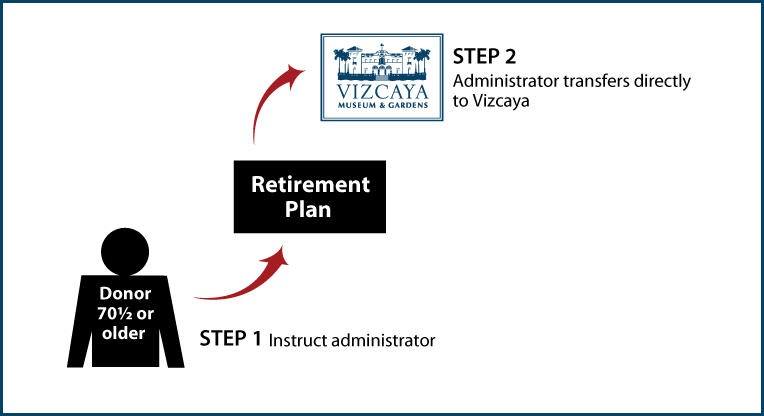

“IRA Rollover” Gifts (QCD) Read More |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer

Support the preservation of Vizcaya by donating online today.

3251 South Miami Ave.

Miami Fl. 33129

305.250.9133